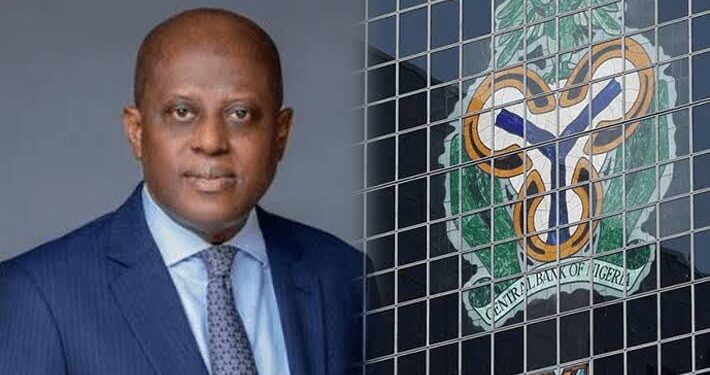

The Central Bank of Nigeria (CBN) says it sold 543.5 million dollars to authorised dealer banks between Sept. 6 and Sept. 30.

According to a statement issued by Omolara Duke, the Director, Financial Markets Department of the CBN, the transaction was through a two-way quote at the Nigeria Foreign Exchange Market (NFEM) on 11 dealing days.

Duke said that the spot sales were to reduce observed market volatility driven by high demand for commodity imports and seasoned demand for FX.

She said that the value date for all the transactions was T+2.

The News Agency of Nigeria (NAN) reports that T+2 refers to the settlement dates of security transactions that occur on a transaction date plus two days.

“This is by taking a clue from the range of rates at which fx was sold by the CBN to authorised dealers.

“The CBN will continue to facilitate the supply of fx into the NFEM as part of its holistic fx management strategy,” she said.

NAN recalls that the CBN had earlier announced the introduction of an Electronic Foreign Exchange Matching System (EFEMS) for Foreign Exchange (FX) transactions in NFEM.

Duke said that the new system was expected to enhance governance, transparency, and facilitate a market-driven exchange rate that would be accessible to the public.

“This development is expected to reduce speculative activities, eliminate market distortions, and give the CBN improved oversight capabilities to effectively regulate the market.

“Authorised dealers will subsequently conduct all foreign exchange transactions in the interbank FX market on the EFEMS approved by the CBN, where transactions will be reflected immediately,” she said.

She said that there would be a two-week test run in November, adding that the apex bank would publish real-time prices when the EFEMS becomes operational.